The turbulence of the market extended to Wednesday, since the actions throughout Asia have faced a renewed pressure from significantly higher taxes on imports in the United States.

The stocks collapsed through Asia, after a day at Wall Street when the stocks were mounted. Taiwan was the worst shot, sinking over 6 percent. The actions in Japan decreased by 4 percent. The drops were between 1.5 and 2 % in South Korea and Hong Kong. The stocks in continental China were slightly higher.

Last week Trump president eradicated investors with the announcement of rates on countries around the world. The taxes on American imports significantly higher on dozen goods from other countries entered into force on Wednesday.

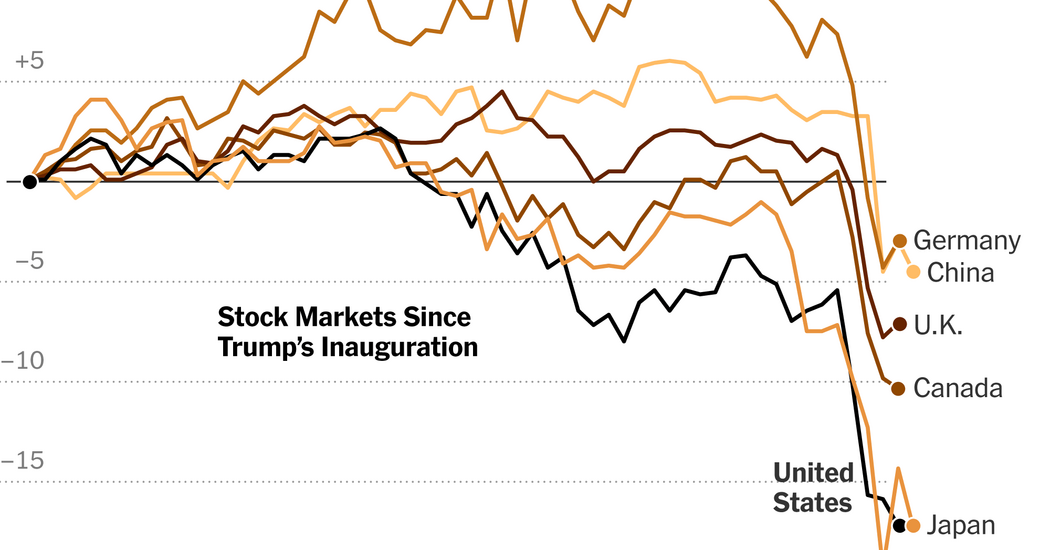

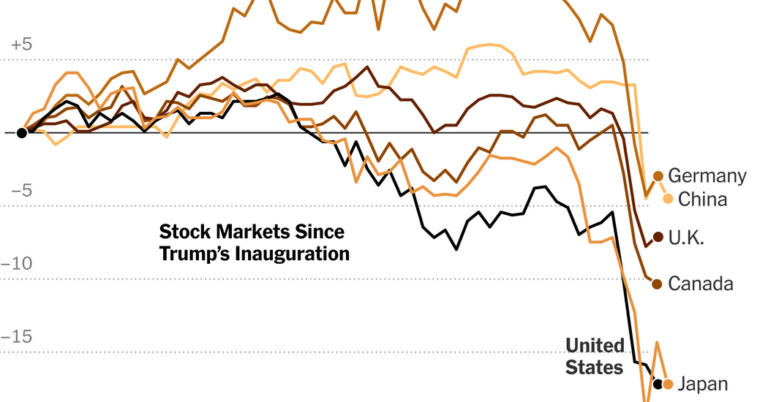

Tuesday, the S&P 500 ended near a bears market, which is a 20 % drop from a recent peak: a symbolic threshold, relatively rare and worried about investors. He closed 18.9 percent below his mid -February record, after collapsing more than 12 % only on days since Mr. Trump announced his new rates.

The Futures S&P 500, which allowed investors to bet on the direction of the Index when it resumes negotiations in New York, were lower than about 2 %.

The administration officials seemed to leave the door open for negotiations that in the end could defuse the commercial war, citing the fact that dozens of countries had approached the United States government in the last few days to attack agreements. But the officials of the White House tried to establish a high bar for what the president is willing to accept, marking a shift of tone after Mr. Trump and his helpers initially reported that they would not have contrasted the rates at all.

“If they come to us with truly great business that advantage for American production and American farmers, I am sure he will listen to,” said Kevin Hassett, director of the National Economic Council of the White House, in an interview on Fox News.

But, he added, “after decades and decades of mistreatment of American workers, it will be difficult to make him decide to really come to the table and sign on the dotted line”.

From the announcement of Mr. Trump last week of new rates, including a basic tax of 10 percent practically all American imports, the countries have responded with their own rates on US assets or with retaliation threats.

China, the largest second world economy, reacted with 34 % rates on American assets that should come into force at noon on Wednesday.

At the beginning of this week, Japan emerged as the first great economy to guarantee priority tariff negotiations with the Trump administration. The news triggered a short wave of listed shares in Tokyo before resuming their decline on Wednesday.