Intel, an icon fall of the Silicon Valley who tries to restore his reputation as a more important company of semi -hounding semiconduers, is working with the Trump administration on a plane to turn the function of his plants as chips in a gigantic Taiwanese rival .

In recent months, Frank Yeary, the interim executive president of Intel, has spoken with administrative officials and leaders of the manufacturing company to Taiwan semiconductors on an agreement that would have separated the manufacturing activities of Intel from the design and in the sector of semiconductor products , according to four people with the knowledge of the plan, who spoke on condition of anonymity.

TSMC, which produces about 90 percent of the most advanced semiconductors in the world, would take control of the Intel manufacturing sector and would take on a majority participation in the sector together with a consortium of investors who could include private equity companies and other technological companies, The four people said the four people.

The Trump administration has encouraged TSMC to agreement. Howard Lutnick, the candidate of President Trump for the Secretary of Commerce, was involved in conversations and considers them one of the most consequential challenges of his new work, two of the people who are familiar with the discussions have said.

It is not clear how much part of the Intel TSMC manufacturing business would take over or how much money would invest the Taiwanese company. The agreement could be limited to Intel’s domestic plants, in States including Oregon, Arizona and New Mexico, or even include structures in countries such as Ireland and Israel, said the people.

Intel’s business prospects have tightened after it has not managed to develop smartphone and artificial intelligence chips. Despite the best efforts of the government to revive the company by promising billions of dollars of subsidies through the biden administration chips act, Intel continued to fight.

Intel and TSMC refused to comment. Mr. Lutnick did not respond to a commentary request.

At the end of last year, Intel’s Board contacted TSMC to evaluate his interest for a sort of partnership, said two people who are familiar with interviews. In January, the CEO of TSMC, CC Wei, met separately with Mr. Lutnick and Mr. Yeary to discuss how a bond could work.

Mr. Yeary spoke regularly with Mr. Lutnick of the idea since then, three of these people have said. The interest of the President of Intel for the splitting of the company has also opened the doors for the suitors interested in acquiring the Intel products sector, including Qualcomm. A spokesman Qualcomm refused to comment.

Some details of the discussions were previously reported by Digitimes, a Taiwan and Bloomberg store.

The question is now if the Trump administration thinks that a sick national champion like Intel is better in the hands of a foreign company or if the administration has to look for another solution.

“Also with the potential support of the United States government by Chips Act and officials eager to see the company bounce and guide the Renaissance of advanced production in the United States, the way to go will be hard,” said Paul Triolo, partner by Albright Stonebridge Group that keeps the industry track.

Hanging on negotiations are questions about the approach of Mr. Trump at the Chips and Taiwan industry, which is clearly different from the strategy of former President Joseph R. Biden Jr. Trump criticized the investments of the Biden Administration in the production of national chips, threatened to impose rates for foreign manufacture chips , accused Taiwan of stolen the semiconductor industry from the United States and has questioned the military support of the United States for the island, who is trying to defend to defend himself against the invasion of Beijing.

In observations to republican legislators at the end of January, Trump said that a significant rate, not subsidies, was all that was necessary to force chip companies to the United States.

“We want them to come back and we don’t want to give them billions of dollars like this ridiculous program that Biden has,” said the president.

In his confirmation of the Senate of January 29, Mr. Lutnick seemed to travel a line attentive to the chips program. He described it as “necessary and important” and a “down payment” to report production in the United States. But Mr. Lutnick refused to commit himself definitively to honor the contracts that companies had already signed with the government.

To appease Mr. Trump, Taiwanese’s officials and businessmen have cultivated ties with people in his orbit, floating new agreements in the gas sector and trying to explain how the production of Taiwanese semiconductors benefits the United States.

Taiwan officials are also monitoring interviews on Intel’s future. For Taiwan, the TSMC domain for the advanced production of chip has become what some commentators call a “silicon shield” that discourages military action by China and encourages the support of the United States.

The president of Taiwan, Lai Ching-te, said on Friday that his government would work with the island semiconductor companies to develop a strategy that turns to the complaints of Mr. Trump protecting the role of Taiwan in the chip sector.

“The Taiwan government will be in mutual contact and discussions with the semiconductor sector to formulate the right strategy, and then there will be further resolutions compared to the proposals with the United States,” said Lai in a press conference.

TSMC could respond to the requests of Mr. Trump simply by building more manufacturing capacities in the United States, said Stacy Rasgon, semi -hounding analyst at Bernstein Research. TSMC, which received up to $ 6.6 billion from the Miglion from Chips Act, is building three factories in Arizona and has the opportunity to expand there.

The idea of breaking Intel speaks of how much the company’s fortunes have changed. Founded in 1968, it became the most precious semiconductor company in the world by designing and producing chips for personal computer and data center. But the company has fought in recent years to innovate and give in to rivals such as Nvidia, the dominant producer of Ai Chips.

Pat Gelsinger, who was appointed Intel CEO of Intel in 2021, promised to change the company by replying its manufacturing activity, but the effort has launched. In November, Intel’s Board forced Mr. Gelsinger to resign.

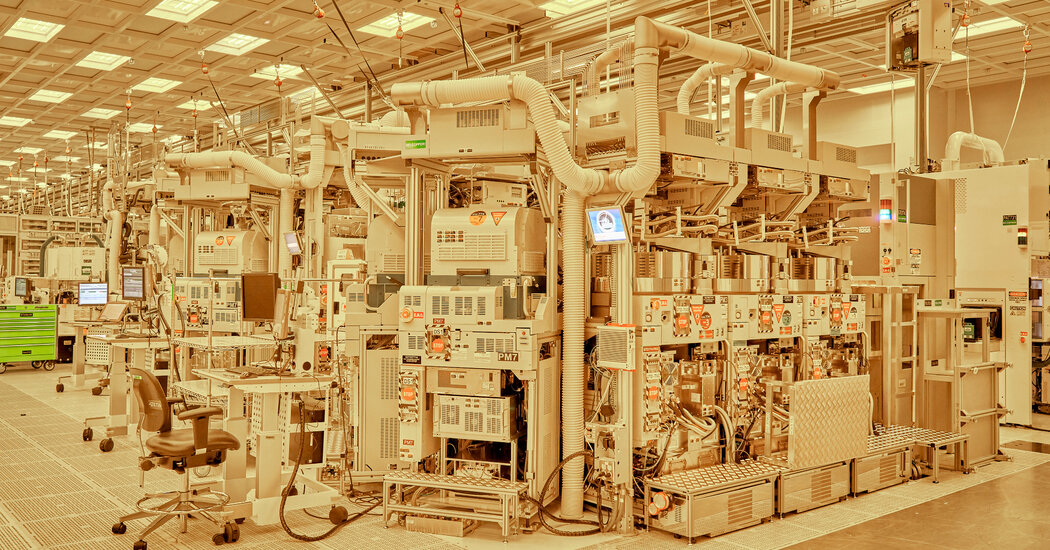

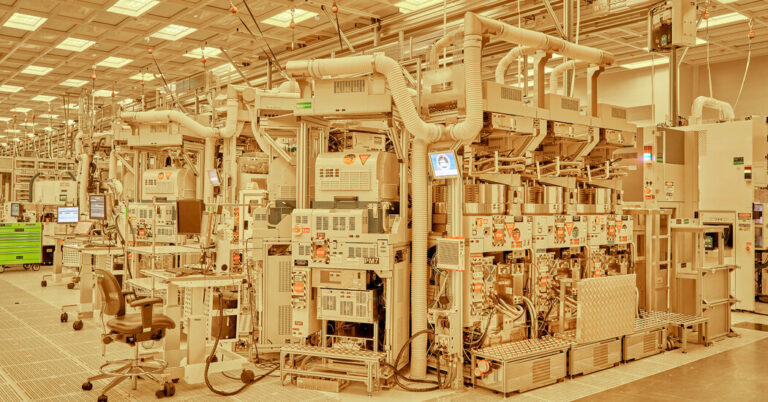

The Intel manufacturing sector, which calls Intel Foundry, recorded an operational loss of $ 13.4 billion in 2024 since sales of customers decreased by 60 percent. Last year, the company said he planned to make the company an independent branch.

With the price of Intel actions down almost 50 percent in the last year, the Intel division could make it vulnerable to an acquisition, said Patrick Moorhead, founder of Moor Insights and Strategy, a technological research company.

“Intel as we know he would stop existing,” he said. “It would be the absolute end of an era.”

Chris Buckley Reports contributed by Taipei, Taiwan.